Aug-06-2024Did you know that the cost of education is rising faster than income?

Did you know that the cost of education is rising faster than income?

NSSO (The National Sample Survey Organization) reported a 2.75-fold increase in annual education costs from 2008 to 2014 but per capita income only increased by 2.49 times.

This suggests that there is inequality, with education costs increasing more than income. Parents suffer due to the high costs of education and are in search of the most efficient ways of saving for their children`s education.

When it comes to selecting the right investment tool for your child’s education, becomes difficult, but mutual funds through SIP are the best way to save for education.

How a SIP in Mutual-funds can help secure a better future for your child:

1) Compounding:

Compounding is just like a snowball that is continuously rolling down a mountain on how to save money and how much it can grow over time. This means that even small savings can accrue interest over time and achieve financial goals, such as creating a child education fund. This accumulation can be observed in SIPs as well as in other forms of investments.

2) Rupee Cost Averaging:

Rupee Cost Averaging entails investing fixed amounts regardless of price changes which helps to balance high/low costs while increasing the unit purchases during low prices.

3) Easy Way of Investing:

SIP is an investment plan that can easily be adopted by every individual since it involves investing a small amount of money frequently to achieve one’s financial goals without necessarily having to invest a lump sum amount of money initially.

4) Financially Disciplined:

It enables you to invest a small amount of cash frequently, thus helping you achieve your monetary objectives in the long run. SIPs are especially good for those who are willing to accumulate their savings steadily and consistently.

5) Small Amount:

Invest as low as Rs. 500 and start a SIP where you can build your investment plan according to your needs & wants and mutual funds let you go for step-up plans.

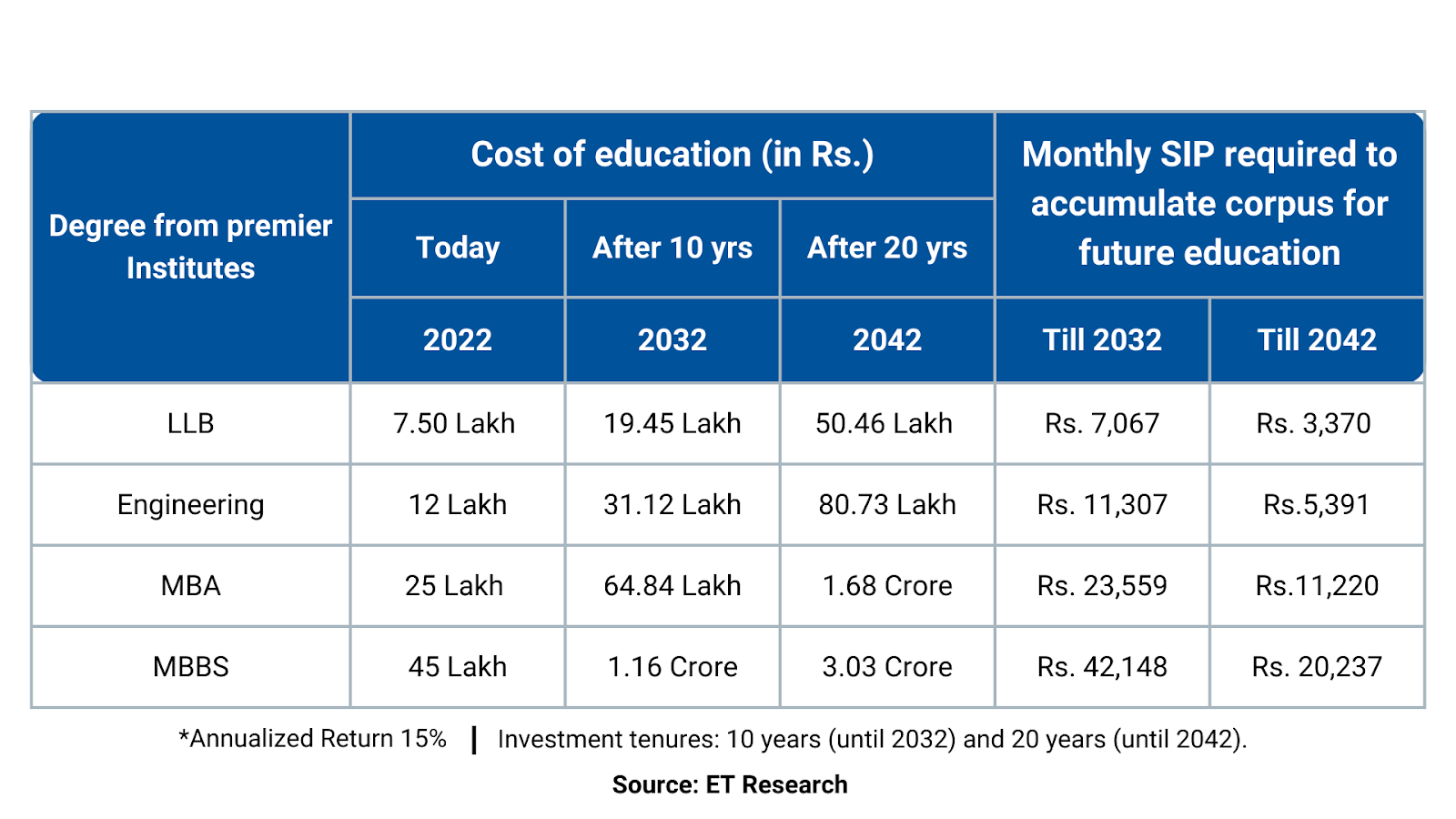

In long-term investment, particularly in fields like higher education, Systematic Investment Plans (SIPs) are common forms of investment that provide exposure to the equities and minimize risk exposure through drip investing in mutual funds. SIP plans offer compounding, where the interest earned is reinvested in the stock for further increase.

The initial investments reap huge gains after approximately 10-20 years. Parents also benefit by having additional income to support the expansion of education.

Regular investment in SIPs can be easily used for children`s education expenses as parents progress through their careers and increase their income.

Conclusion

In today`s world, starting investment for the future is very important due to the high educational inflation. The strategy should align with your income, target corpus, investment horizon, and risk appetite.

Investments made during this time minimize future expenses, guide your child towards the choice of career & give high yields, manage risks, and contribute towards education costs.

The right time to invest in your child`s education is now, as there is no appropriate or right time to do so.

Feel free to contact us if you’d like to know more about how investment helps to achieve your financial goal!