Planning for retirement is really important for a good money plan, especially when you`re young. If you start getting ready for the future sooner, you`ll have enough time to handle unexpected stuff and enjoy a comfy life. There are lots of reasons why planning for retirement matters.

What is Retirement Planning?

Retirement planning is all about setting goals for the money you`ll need after you stop working. It involves figuring out how much you`ll have coming in and going out, and making a plan to save and invest so you can reach those goals. It might not seem important when you first start earning, but getting a head start is a smart move. Life can throw unexpected things your way, so being ready financially is a good idea. Everyone has their vision for retirement, but whatever it looks like, it`ll need money to make it happen. Retirement planning is simply about setting goals for your income after you retire and figuring out how to reach them.

Basically, retirement planning is about making money plans now so you can live the way you want later. There are lots of ways to do it, depending on what works best for you.

Importance:

Planning for retirement has a lot of perks! Here`s why it`s so important:

1. Independence:

When you plan for retirement, you can live comfortably without relying on family. It lets you achieve your dreams without financial worries.

2. Life Expectancy:

Retirement can be a long time, so planning early is key. You`ve got many years ahead after you retire, so preparing ahead matters.

3. Medical Costs:

Health expenses can be crazy high. Retirement planning helps cover these costs and ensures good medical care when you need it.

4. Tax Benefits:

Planning for retirement smartly can reduce taxes and boost savings. It`s a win-win for now and the future.

5. Peace of Mind:

Stressing about money isn`t good for your health. Retirement planning brings peace, making life happier and healthier in the long run.

F&Qs:

Why do you need one?

Retirement planning secures early retirement, reduces stress, covers costs, fulfils goals, maintains lifestyle, ensures family security, grants independence, and guards against inflation.

How to build one?

Think about what you want in retirement. Figure out how much you`ll need, considering inflation. Choose a good retirement plan to save and be ready for your goals. Seek professional guidance and plan with your relationship manager.

When to start one?

Begin planning for retirement between 25 to 40 for better returns; early investing lets your money grow, keeping you financially ready for later.

Cta

How to Choose the Best Retirement and Pension Plan?

Choosing the right retirement plan is super important, even when you`re just starting out. Here`s a simple guide to help you pick the best one:

1. Know Your Costs:

Figure out how much money you`ll need for things like bills and other big expenses when you stop working. Don`t forget about healthcare costs, which tend to go up as you get older.

2. Beat Inflation:

The money you save now has to keep up with how prices go up over time. Make sure your investments grow enough to cover your future living costs.

3. Deal with Debts:

If you owe money, think about how long you`ll be paying it off—even after you retire. There are tools, like retirement calculators, that can help you plan for this.

4. Check the Plan:

Understand what each retirement plan offers and how it fits your goals. Knowing these details makes it easier to see what life might look like after retirement.

By keeping these things in mind, you`ll be better equipped to choose a retirement plan that fits your needs and sets you up for a comfortable future!

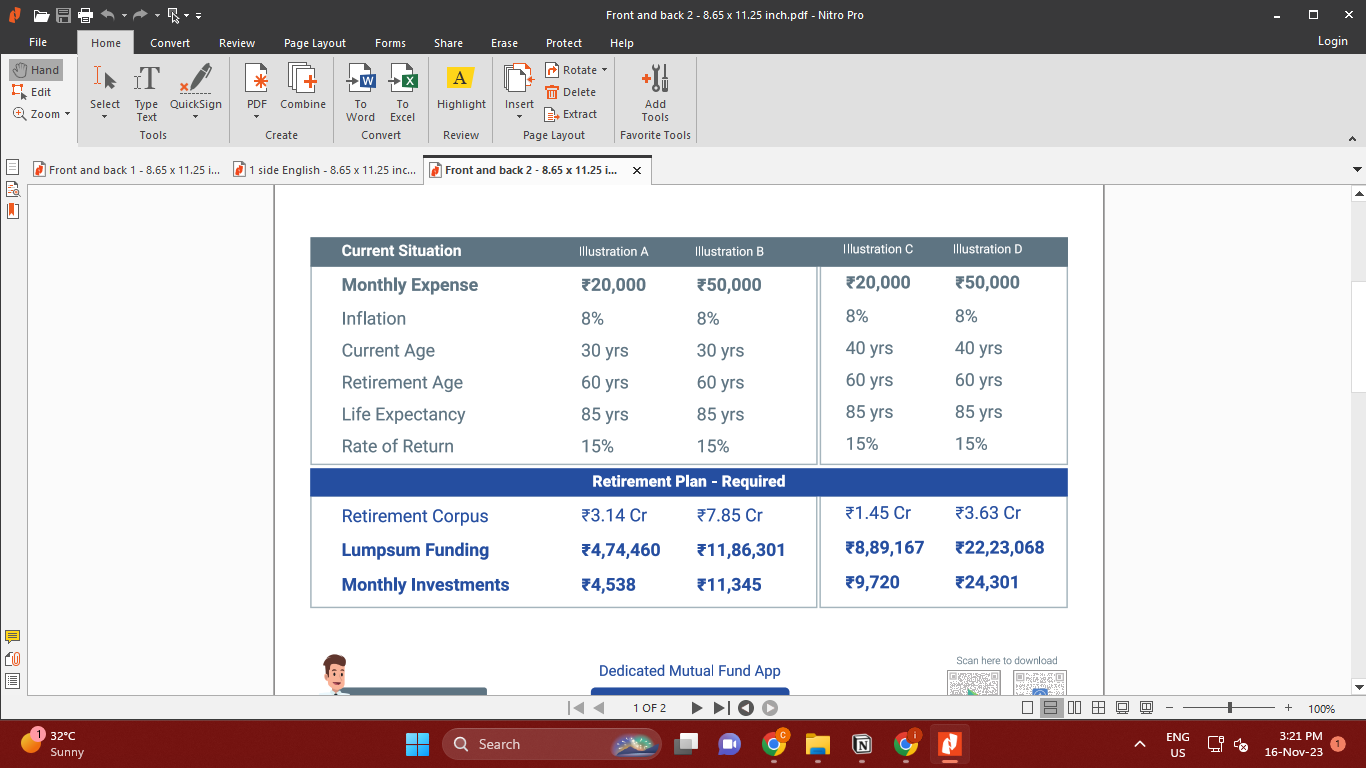

Calculation:

For More Calculation Download Bachat App Click Here.

3) Funds:

HDFC Retirement Savings Fund Equity Plan Direct-Growth

ICICI Prudential Retirement Fund Pure Equity Plan Direct-Growth

HDFC Retirement Savings Fund Equity Plan Reg

ICICI Prudential Retirement Fund Hybrid Aggressive Plan Direct-Growth

SBI Retirement Benefit Fund Aggressive Reg

Conclusion:

Early you start, early you retire!

In summary, starting your retirement plan early is key! It`s not just about money—it`s about independence, covering future expenses, and reducing stress. By planning ahead with the best investment broker in India and Choosing our Dedicated mutual fund investment app which is Called BACHAT MF, you secure a comfortable retirement, take care of medical costs, and even save on taxes. From setting goals to choosing the right retirement plan, the earlier you begin, the better off you`ll be. So, kickstart your plan today for a smoother road to your dream retirement!